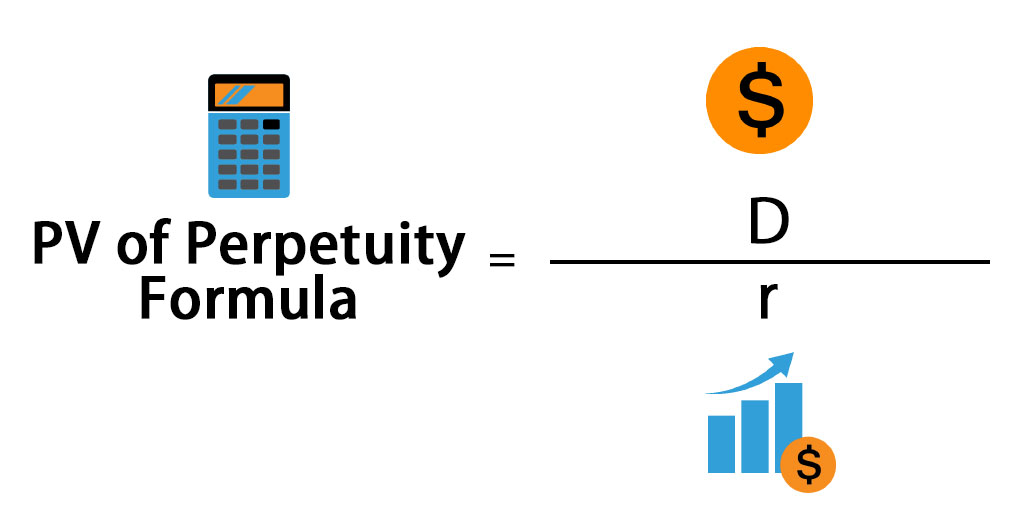

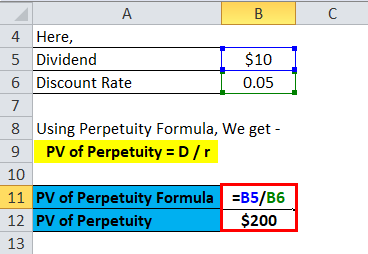

Perpetual bond formula

James Bond Truly Is Dead. Learn to determine the value of a business.

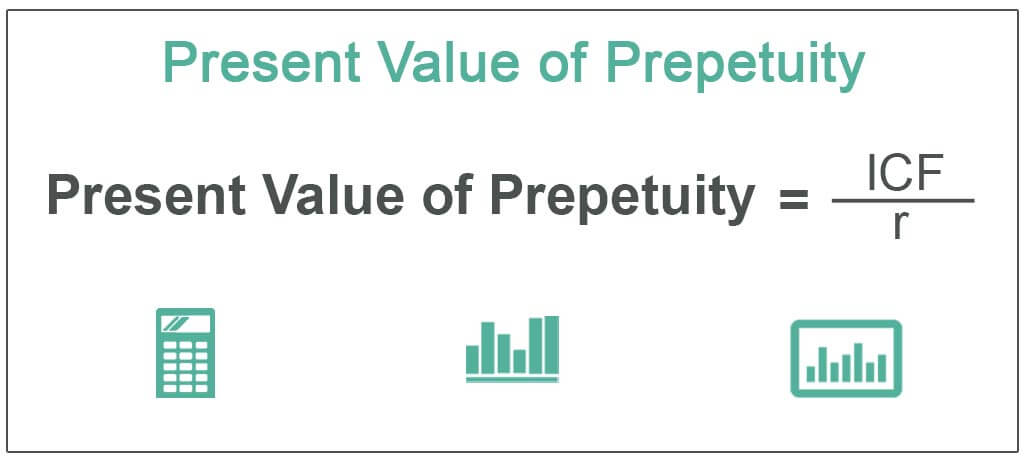

Perpetuity Formula And Financial Calculator Excel Template

Period Number n.

. Daniel Craig Sports New Look 1 August 2022 by Bec Milligan. For example if the annual coupon of the bond were 5 and the. L is the specific latent heat.

The formula for specific latent heat is. For a bond the discount rate would be equal to the interest rate on the security. After the 568 per cent perpetual securities were not redeemed on their first call date on July 8 2021 the distribution rate was reset at 49817 per cent per annum for the period from the first.

The discount applies to your online purchase subtotal for the pickup in-store products only. The Rolex Oyster Perpetual is the perfect watch for anyone looking for a timeless understated watch. Our global writing staff includes experienced ENL ESL academic writers in a variety of disciplines.

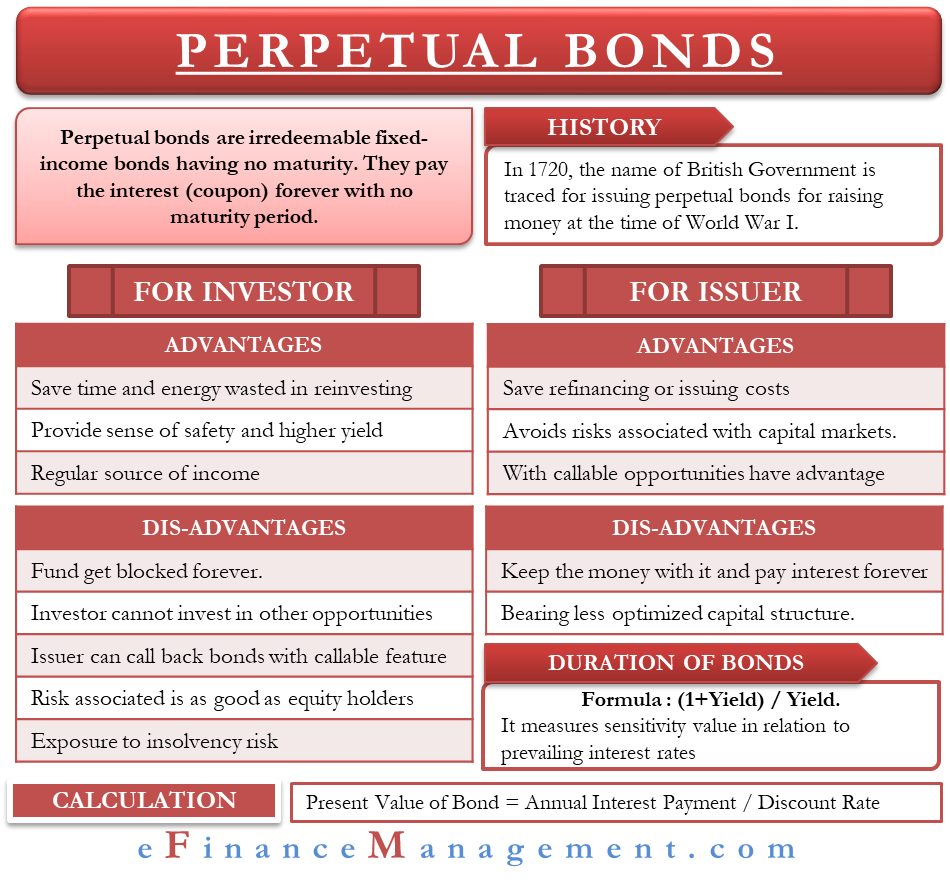

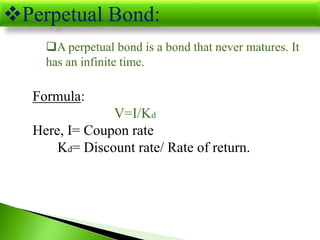

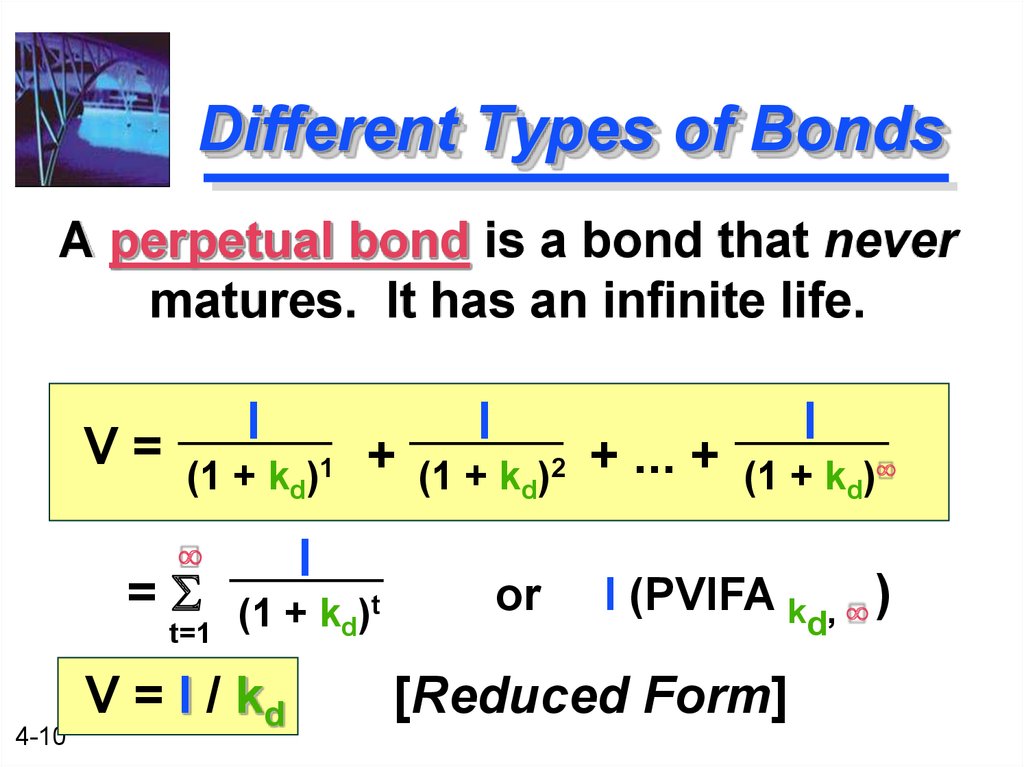

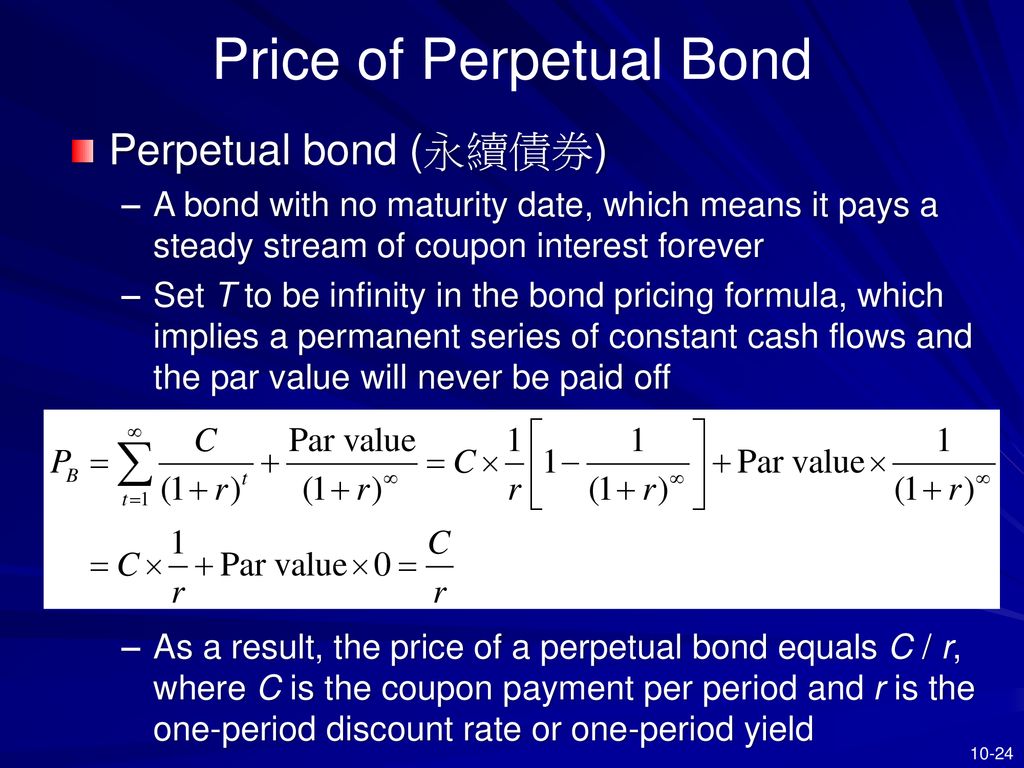

The two formulas can be combined to determine the present value of the bond. A classic example would be that of a perpetual bond which promises to pay interest. The value of the perpetual bond is the discounted sum of the infinite series.

In finance the duration of a financial asset that consists of fixed cash flows such as a bond is the weighted average of the times until those fixed cash flows are received. The TED spread is the difference between the interest rates on interbank loans and on short-term US. A perpetual bond is a fixed income security with no maturity date.

The Oyster Perpetual Date logo affixed to each model guarantees water and dust tightness as well as automatic movement while at the same time indicating the practical date functionThe Oyster Perpetual Date belongs to the cheaper. A typical coupon bond is composed of two types of payments. Given this drawback the major.

For some bonds such as in the case of TIPS the underlying principal of the bond changes which results in a higher interest payment when multiplied by the same rate. Antecedent and perpetual impotence to have intercourse whether on the part of the man or the woman whether absolute or relative nullifies marriage by its very nature. Get 247 customer support help when you place a homework help service order with us.

The discount rate depends upon the riskiness of the bond. Q is the heat retained or discharged. The ideal gas law also called the general gas equation is the equation of state of a hypothetical ideal gasIt is a good approximation of the behavior of many gases under many conditions although it has several limitations.

This lets us find the most appropriate writer for any type of assignment. However for a growing perpetuity there is a perpetual growth rate attached to the series of cash flows. TED is an acronym formed from T-Bill and ED the ticker symbol for the Eurodollar futures contract.

The most widely recognized kinds of consistent temperature forms are stage changes for example liquefying solidifying vaporization or. Initially the TED spread was the difference between the interest rates for three-month US. Blacks model can be generalized into a class of models known as log.

M is the mass of a substance. If the impediment of impotence is doubtful whether by a doubt about the law or a doubt about a fact a marriage must not be impeded nor while the doubt remains declared. One major drawback to these types of bonds is that they are not redeemable.

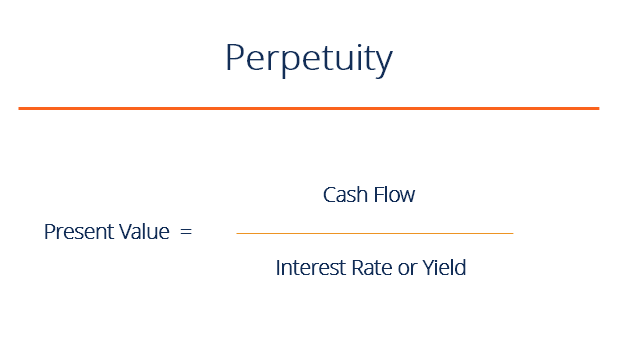

This article breaks down the DCF formula into simple terms with examples and a video of the calculation. Treasuries contracts and the three-month Eurodollars. Perpetuity refers to an infinite amount of time.

When n the PV of a perpetuity a perpetual. Daily inflation-indexed bonds pay a periodic coupon that is equal to the product of the principal and the nominal coupon rate. The terminal value is calculated using the perpetual growth rate or exit multiple methods.

Subtotal refers to the amount of order before taxes and shipping. It is an important part of the discounted cash flow formula and accounts for as much as 60-70 of the firms value and thus warrants due attention. Perpetual growth where the business is assumed to grow at a reasonable fixed growth.

I Required rate of return. A stream of coupon payments similar to an annuity and a lump-sum return of capital at the end of the bonds maturitythat is a future payment. A perpetual annuity also called a perpetuity promises to pay a certain amount of money to its owner forever.

We will guide you on how to place your essay help proofreading and editing your draft fixing the grammar spelling or formatting of your paper easily and cheaply. For example if the investment stated that 1000 would be issued in the following year but at a 2 growth rate then the annual cash flows would increase 2 year-over-year YoY. In finance it is a constant stream of identical cash flows with no end such as with the British-issued bonds known as consols.

It was first stated by Benoît Paul Émile Clapeyron in 1834 as a combination of the empirical Boyles law Charless law Avogadros law and Gay-Lussacs law. Audi Reveals Its Joining The Formula 1 Grid In 2026 26 August 2022 by Jamie Weiss. Find in-depth news and hands-on reviews of the latest video games video consoles and accessories.

Terminal value is the estimated business value beyond the period for which cash flows are forecasted. In a perpetual bond there is no maturity or terminal value. The formula for calculation of value of such bonds is.

The concept of a. Its primary applications are for pricing options on future contracts bond options interest rate cap and floors and swaptionsIt was first presented in a paper written by Fischer Black in 1976. When the price of an asset is considered as a function of yield duration also measures the price sensitivity to yield the rate of change of price with respect to yield or the percentage change in price for a parallel.

Eligible brands include Wholehearted Good Lovin You Me So Phresh Well Good Reddy Harmony Bond Co Good2Go EveryYay Bowlmates Imagitarium and Leaps Bounds. The Rolex Oyster Perpetual Date is considered a classic unpretentious watch. The Black model sometimes known as the Black-76 model is a variant of the BlackScholes option pricing model.

The sleek no-frills design is equally popular with men and women. Provide AmericanBritish pronunciation kinds of dictionaries plenty of Thesaurus preferred dictionary setting option advanced search function and Wordbook. It is not too noticeable on the wrist but can still impress with its classic designIn addition the Oyster Perpetual is one of the more affordable watches from Rolex but without losing prestige making it perfect for beginnersThe strikingly unobtrusive Oyster Perpetual is elegant.

V Value of bond I Annual interest.

Yield To Call Ytc Bond Formula And Calculator Excel Template

Perpetuity Formula Calculator With Excel Template

Perpetuity Formula Calculator With Excel Template

Chapter 4 The Valuation Of Longterm Securities 4

Perpetual Bonds Define Advantages Disadvantages Calculate Duration

Pv Of Perpetuity Formula With Calculator

Perpetuity Meaning Formula Calculate Pv Of Perpetuity

11 2 Chapter 42 Why Shall We Know The Valuation Of Long Term Securities Make Investment Decisions Determine The Value Of The Firm Ppt Download

What Is A Perpetuity Definition Formula Video Lesson Transcript Study Com

Impossible Finance The Perpetual Zero Coupon Bond By Martin C W Walker Medium

Bond Valuation

Bond Yield Formula Calculator Example With Excel Template

/dotdash_Final_Current_Yield_vs_Yield_to_Maturity_Nov_2020-01-c4613a2a2029466a960d9e3594841a03.jpg)

Current Yield Vs Yield To Maturity

Present Value Of Perpetuity How To Calculate It Examples

How Bonds Work India Dictionary

Chapter 10 Bond Prices And Yields Ppt Download

Perpetuity Definition Formula Examples And Guide To Perpetuities