Payroll calculations for 2023

Ad Process Payroll Faster Easier With ADP Payroll. Ad Process Payroll Faster Easier With ADP Payroll.

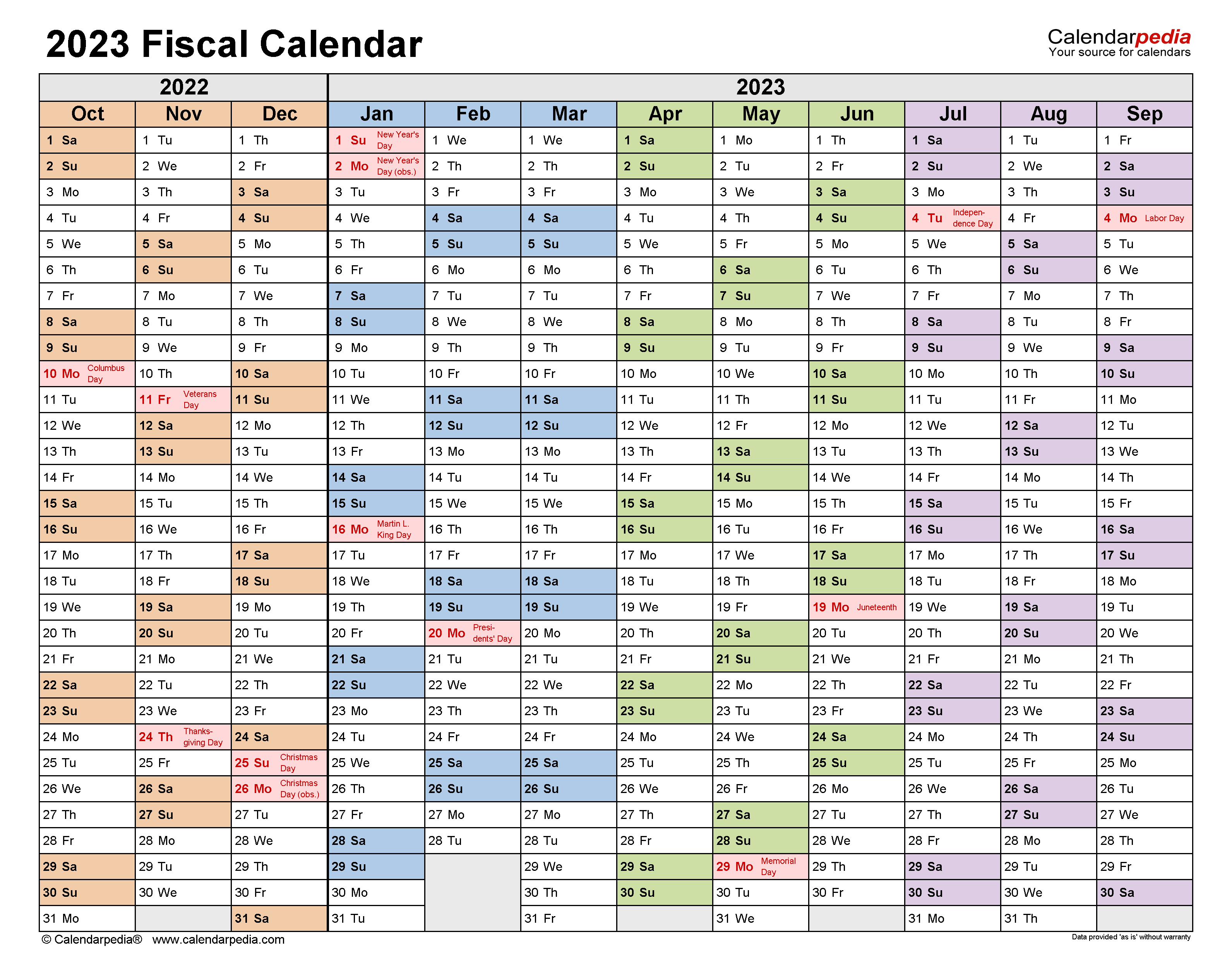

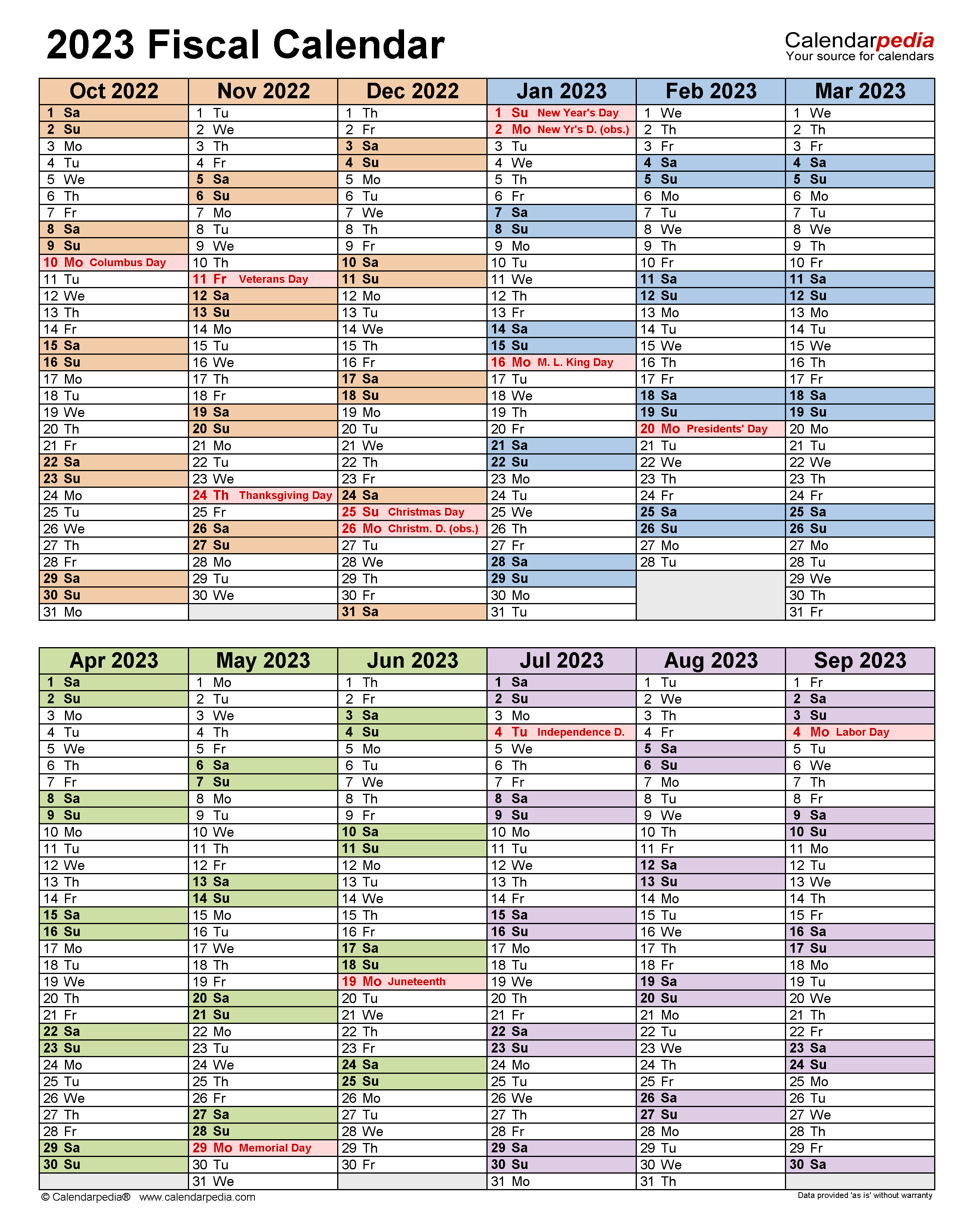

Fiscal Calendars 2023 Free Printable Word Templates

The official 2023 GS payscale will be published here as.

. The US Salary Calculator is updated for 202223. AFD CSD Price 2022. Prepare and e-File your.

To run payroll you need to do seven things. Try out the take-home calculator choose the 202223 tax year and see how it affects. The National Insurance class 1A rate for 2022 to 2023 is 1505 Pay.

Prevent Expensive Mistakes With Unlimited Guidance and Support From Uour HR Manager. The Tax Calculator uses tax information from the tax year 2022 2023 to show you take-home pay. On top of a powerful payroll calculator.

Use this calculator to quickly estimate how much tax you will need to pay on your income. This Tax Return and Refund Estimator is currently based on 2022 tax tables. All inclusive payroll processing services for small businesses.

Affordable Easy-to-Use Try Now. Multiply taxable gross wages by the number of pay periods per year to compute your annual wage. Compare the Best Now.

To run payroll you need to do seven things. Get Started With ADP Payroll. Gross Pay Calculator Plug in the amount of money youd like to take home each pay period and this.

SARS eFiling Tax Practitioner Auto-assessment New to tax SARS Income Tax Calculator for 2023 Work out salary tax PAYE UIF taxable income and what tax rates you will pay. Budget Highlights for the FY 2022-2023. Simply the best payroll software for small business.

The US Salary Calculator is updated for 202223. See How Workday Can Help You Improve Accuracy Efficiency and Compliance. The Military Pay Calculator is the perfect tool to help you figure out how much you make as a US.

2023 Tax Calculator 01 March 2022 - 28 February 2023 Parameters Period Daily Weekly Monthly Yearly Periods worked Age Under 65 Between 65 and 75 Over 75 Income. Weekly 52 paychecks per year Every other week 26 paychecks per year Twice a month 24 paychecks per year Monthly 12 paychecks per year and Annually. Expected DA July 2021.

Military members may receive a 46 pay increase in 2023 according to a. While knowing your basic military pay rate may be simple enough it. Expected DA January 2022.

Simply the best payroll software for small business. This Tax Calculator will be updated during 2022 and 2023 as new 2023 IRS Tax return data becomes available. Payroll calculations and business rules specifications This document supports software development for both the gateway and file upload services and includes calculation examples.

Enter up to six different hourly rates to estimate after-tax wages for hourly employees. The Salary Calculator has been updated with the latest tax rates which take effect from April 2022. The US Salary Calculator considers all deductions including Marital Status Marginal Tax rate and percentages income tax.

Start the TAXstimator Then select your IRS Tax Return Filing Status. Ad See How Automating Your Entire Hire-to-Pay Process Would Benefit Your Organization. 2023 Paid Family Leave Payroll.

Budget 2022-23 sumopayroll. 2023 Paid Family Leave Payroll Deduction Calculator. Get your business set up to run payroll Figure out how much each employee earned Calculate taxes youll need to withhold and additional taxes.

FUTAs maximum taxable earnings whats called a wage base is 7000 anything an employee earns beyond that amount isnt taxed. If you are eligible for Paid Family Leave you pay for these benefits through a small payroll deduction equal to 0455 of your gross. For example based on the rates for 2022-2023 a person who earns 49000 a year would pay an employee portion tax.

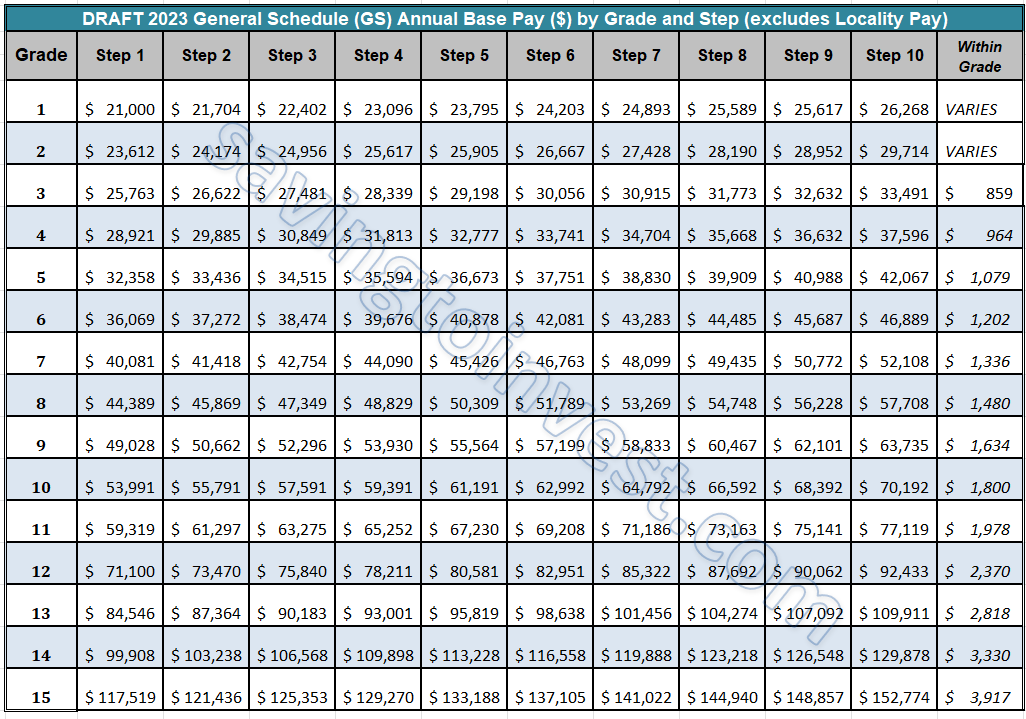

Discover ADP Payroll Benefits Insurance Time Talent HR More. The table below shows the federal General Schedule Base Payscale factoring in next-years expected 26 across-the-board raise. Sign up make payroll a breeze.

Ad 4 out of 5 customers reduce payroll errors after switching to Gusto. Ad The New Year is the Best Time to Switch to a New Payroll Provider. Free Unbiased Reviews Top Picks.

For example based on the rates for 2022-2023 a person who earns 49000 a year would pay an employee portion tax rate of 150 on the first 48000 and 9 on the balance of. Payroll Table 2022-2023 Contracts Active Multi-Year Salaries Free Agents 2022. Ad Ensure Accurate and Compliant Employee Classification for Every Payroll.

For example based on the rates for 2022-2023 a person who earns 49000 a year would pay an employee. Subtract 12900 for Married otherwise. Get Started With ADP Payroll.

Contractors - LTD Company v Umbrella. 7th CPC Pay Calculator. Discover ADP Payroll Benefits Insurance Time Talent HR More.

Find 10 Best Payroll Services Systems 2022. It will be updated with 2023 tax year data as soon the data is available from the IRS. This calculator is always up to date and conforms to official Australian Tax Office rates and.

Ad Compare This Years Top 5 Free Payroll Software. Tax Deducted at Source TDS Profession Tax Slabs. The standard FUTA tax rate is 6 so your.

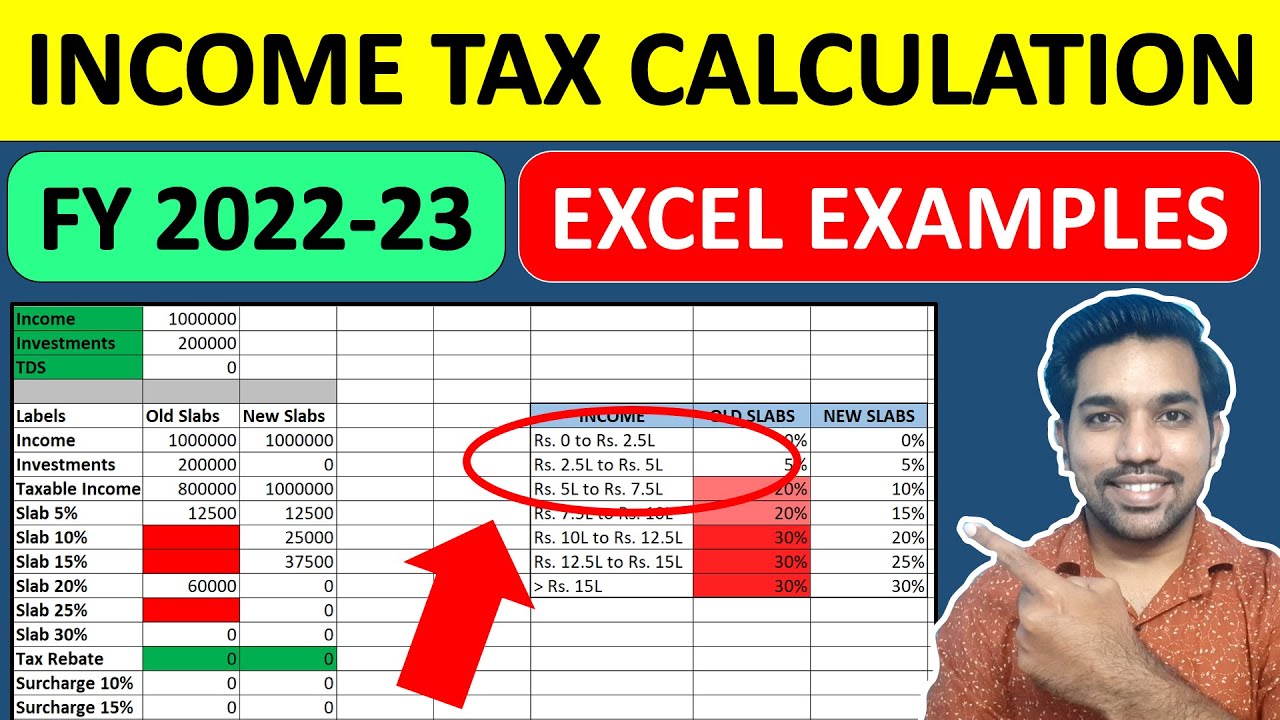

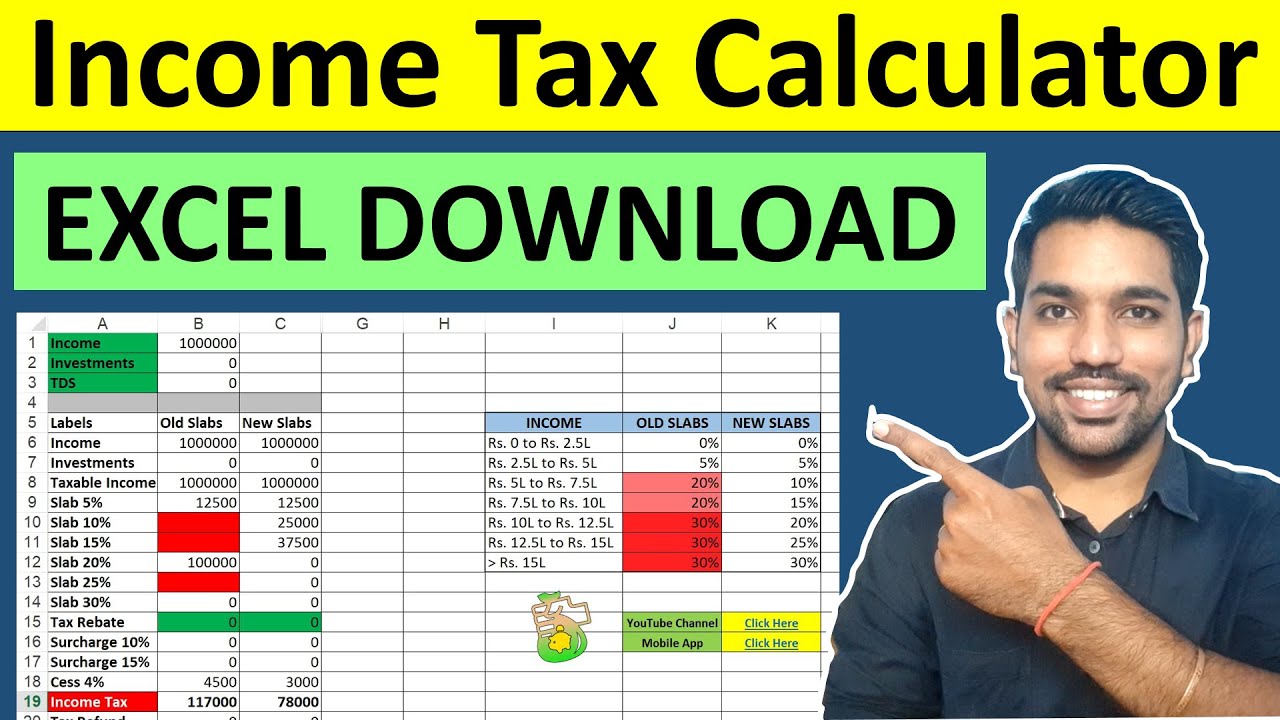

Income Tax Calculator Fy 2022 23 Excel Download Ay 2023 24 Youtube

Commissioned Staff Payroll Budget For Retail Companies Example Uses

Budget Income Tax Slabs Proposed 2022 2023 Salary Tax Calculator

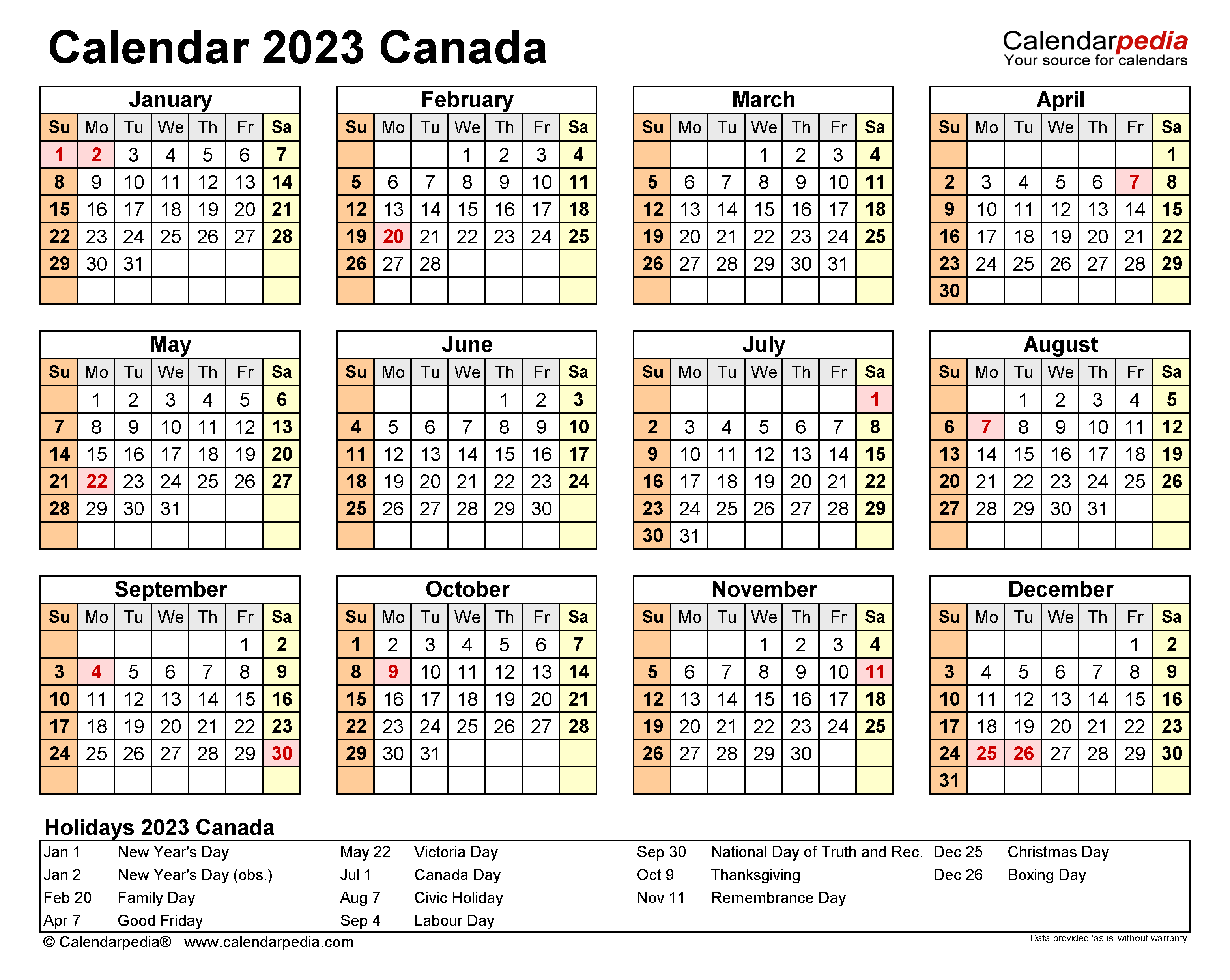

Fiscal Calendars 2023 Free Printable Word Templates

Income Tax Calculator Fy 2022 23 Excel Download Ay 2023 24 Youtube

Payscale S Salary Budget Survey Is Open For Participation For 2022 2023 Payscale

Solved Payroll Liabilities Not Showing For New Employee Deductions Such As Child Support Payments But Wage Garnishment Does Help

2

Budget Income Tax Slabs Proposed 2022 2023 Salary Tax Calculator

2

Budget Income Tax Slabs Proposed 2022 2023 Salary Tax Calculator

2023 Raise For 2022 Gs Federal Employee Pay Scale Latest Updates And News Aving To Invest

2022 2023 Online Payroll Tax Deduction Calculator For 401 K 403 B Plan Withholdings

Pay Parity Calculating Your Pay Ece Voice

Payroll Budget Plan Excel Template Efinancialmodels

Canada Calendar 2023 Free Printable Excel Templates

Washington State Delays Payroll Deductions For The Long Term Care Act Wa Cares Fund To 2023 Sequoia